- #Dept of education ach transaction student ln how to

- #Dept of education ach transaction student ln download

- #Dept of education ach transaction student ln free

#Dept of education ach transaction student ln download

You can download a deferment form the ECSI Forms Page, or by clicking on the respective loan type below: There are different types of deferments available to you depending on when you borrowed and the type of loan you received. You may *defer or delay the repayment of your loan for a defined period of time. What types of deferments are available?Ī. This information will help to answer the most commonly asked questions while in repayment. If you have any questions about overpayments, please contact us.In an effort to better assist you, we are providing the following information and links regarding student loan repayment. Law promissory notes or loan agreement(s), the default method (Curtailment or Pay Ahead) we use to apply overpayments depends on the

#Dept of education ach transaction student ln how to

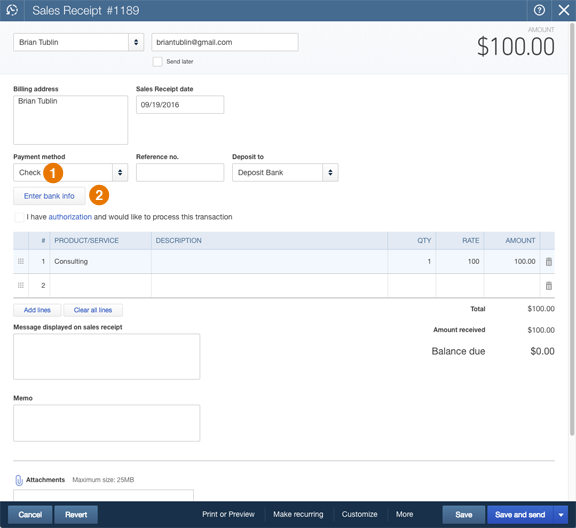

If we receive no instructions on how to apply any overpayments or if instructions are not consistent with applicable We will apply any future overpayments on your account in the same way, unless you instruct us otherwise.

If you instruct us on applying overpayments a certain way, if consistent with applicable law and promissory notes or loan agreement(s), You can call UAS at 87 and speak to a representative to discuss your overpayment preferences. While making a payment to your loan(s) through the portal account, you can select how to apply overpayment. You can login to your portal account and under Account Settings select how you would like to apply any overpayments. There are two options available: Curtailment or Pay Ahead. On applicable loan(s) from the date of the original overpayment, even if a “PayĪhead” adjustment from a single overpayment occurs over multiple statements. Overpayment amounts under the “Pay Ahead” method apply to the principal If there is any remaining amount in the Pay Ahead category after the first “Pay AheadĪdjustment,” it will carry forward to the next statement cycle(s) and repeat the Thus, the statement a borrower receives after the first overpayment under the PayĪhead method may indicate a lower minimum payment due for that month in some circumstances.

The normally required minimum payment amount or the amount in the Pay Ahead category, whichever The overpayment amount towards the principal portion of the monthly amount due, with a ceiling of Statement, the system will automatically generate a “Pay Ahead Adjustment” that will be applied to Under the Pay Ahead method, if you make any payment more than the monthly amount due (“overpayment”),Īmounts which exceed the monthly amount due will be categorized in a “Pay Ahead” status. The next statement will bill the normal minimum amount due on Regulations, promissory note or loan agreements. Under the curtailment method, if you make any payment more than the monthly amount due (“overpayment”),Īmounts which exceed the monthly amount due will be applied to the most recent open statement periodĪnd will be allocated to reduce the outstanding principal balance, if consistent with applicable Also, an extended repayment period due to a reduced payment amount means more interest may be paid over the life of the loan.įor information about federal student loan consolidation, go to.

#Dept of education ach transaction student ln free

When considering the option to consolidate a Federal Perkins Loan into a private refinance loan, be aware that doing so will eliminate the current available benefits associated with a Perkins Loan, such as the fixed 5% interest rate, interest free periods during deferment, and the ability to qualify for cancellation, deferment or forbearance benefit programs. As everyone’s financial situation is different, consumers need to explore companies that offer consolidation services and discover through those companies the best option for them. Consolidation can be used as an opportunity to refinance your student loan debt load to reduce monthly payment amounts and/or potentially reduce your interest rate(s). Consolidation can offer certain advantages, such as a single loan or a reduced number of total loans. Consolidation may be an option if you have one or multiple loans with one or multiple lenders, including federal or private student loan types. Loan consolidation is offered by the Department of Education (federal loans only) and by private financial institutions. Please continue reading for more information on loan consolidation. UAS does not offer loan consolidations and cannot consolidate your loans because UAS is not a lending institution.

0 kommentar(er)

0 kommentar(er)